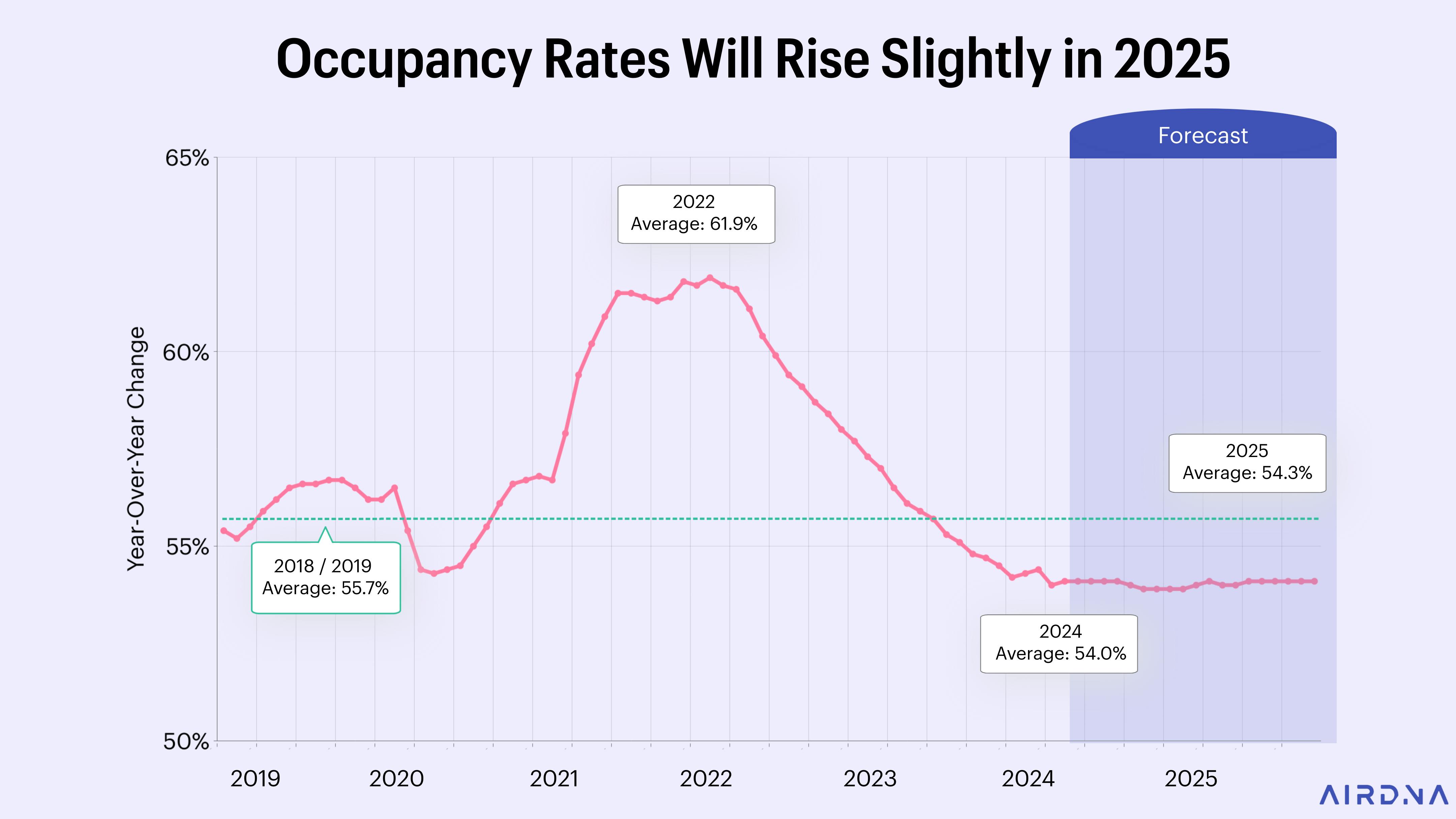

Slowing supply growth and increasing demand have ended a trend that started in 2021: rapidly shrinking occupancy rates from the highs of that year. This decline has almost stopped, and we expect it to slowly reverse in the coming years, though very gradually. High interest rates have slowed supply, but we expect the Fed to cut rates before the end of the year and continue doing so until they’ve balanced inflation control and labor market strength. Supply growth will slow gradually for the rest of 2024 and 2025.

When financial markets stabilize, there may be a period of attrition, which means a reduction in the number of available rentals as some hosts leave the market. This could affect occupancy rates. However, we currently expect occupancy to stabilize at a rate slightly below pre-pandemic levels. The end of falling occupancy will give hosts more pricing power.

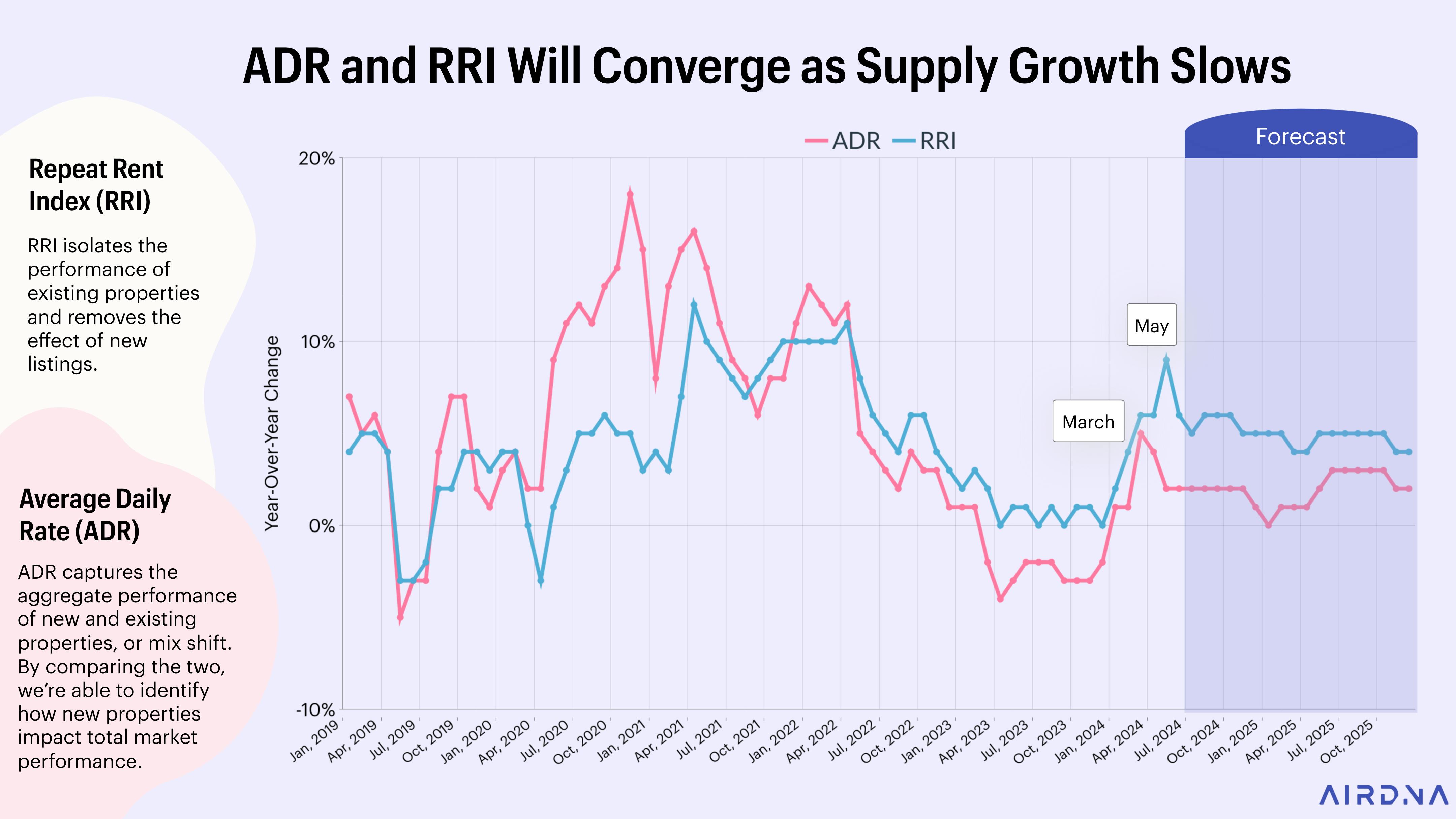

In 2023, tight budgets and economic anxieties impacted how hosts chose to price their rentals. The AirDNA Repeat Rent Index (RRI), which tracks the price changes of existing rentals, showed flat or minimal growth between April and December 2023. This means that prices for existing properties barely changed. ADR growth was lower, ranging between -2% and -4% during the same period. This means that new listings in 2023 generally had lower rates than existing supply, indicating hosts were trying to attract budget-conscious travelers. It’s possible that lower prices were even an attempt to undercut existing rentals.

In 2024, there is a growing sense of optimism about the economy. Inflation has dropped to nearly a third of its peak, and talk of a recession has mostly disappeared among economists. With supply growth slowing, occupancy rates have stabilized, giving hosts more pricing power.

Together, these conditions spurred a simultaneous uplift in growth rates for both ADR and RRI at the beginning of 2024. This positive trend has continued through May and is expected to continue through 2025.

For Investors looking to invest in or acquire a STR, contact us at 312.433.9300 x 20. The Investment Grade team is Funding STR acquisitions in markets across the country